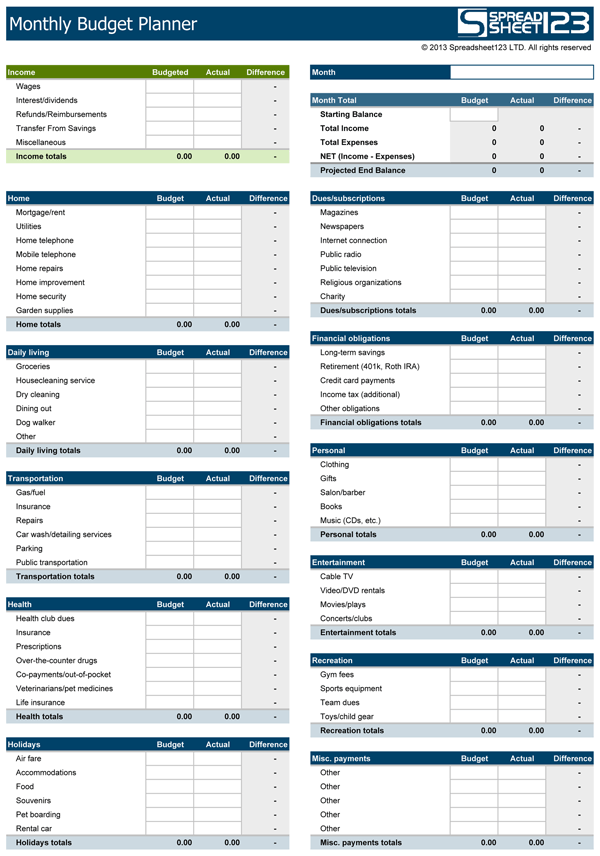

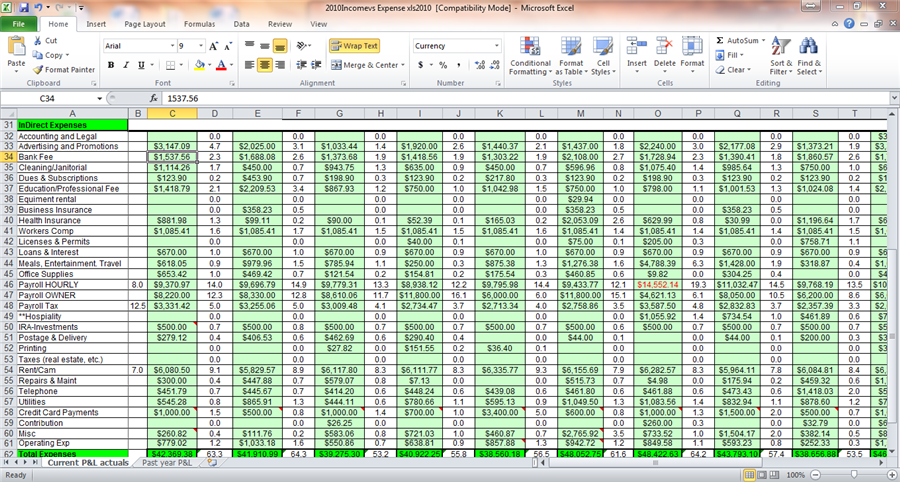

Spreadsheets - Business Income & Expenses … read more »īelow is a list of the detail required to be able to process BAS documentation for lodgement:Bank statements for the full BAS period – Make sure you have all the… read more ».Rental statements from property agents – these will include the rental income, property agent fees and commissions, and advertising expenses.Tax Return Checklist for Rental Property Income Please get in touch if you'd like instructions on how… read more » With the increase in people using the sharing economy to supplement their income, for instance with AirBnb and Stayz, it’s helpful to keep in mind the tax implications these sorts… read more »Īll documents for your tax return can now be sent to us via your client portal, using the upload function. What is Division 293 Tax?The Division 293 tax was introduced on 1 July 2012 for individuals with an annual income greater than a threshold of $300,000, in an effort to… read more »

When purchasing a property for investment purposes or changing the status of your main residence to an investment property there are several important steps you should take and documents you… read more »

Investment Properties - things to do, items to keep It generally only applies if you earn business… read more » What are PAYG Instalments?Pay As You Go (PAYG) instalments is a system for making regular payments towards your expected income tax liability. The private health cover rebate changed on the 1st July 2015:Most people were receiving a standard 30% rebate on their premiums, either taken along the way as reduced premiums or… read more » Since 1 July 2015 there are only two methods available for claiming a deduction for motor vehicle expenses:Logbook, orCents per kilometre All motor vehicle claims need to be supported by… read more » Purchasing a rental propertyWhen purchasing a financed rental property you may consider:o The interest on the debt is deductible in contrast to the interest on the debt for your main… read more » Non-residents are not subject to the $18,200 tax free threshold and are not required to pay the Medicare levy.

These rates apply to individuals who are Australian residents for tax purposes: read more » Residents: Personal tax rates and thresholds

0 kommentar(er)

0 kommentar(er)